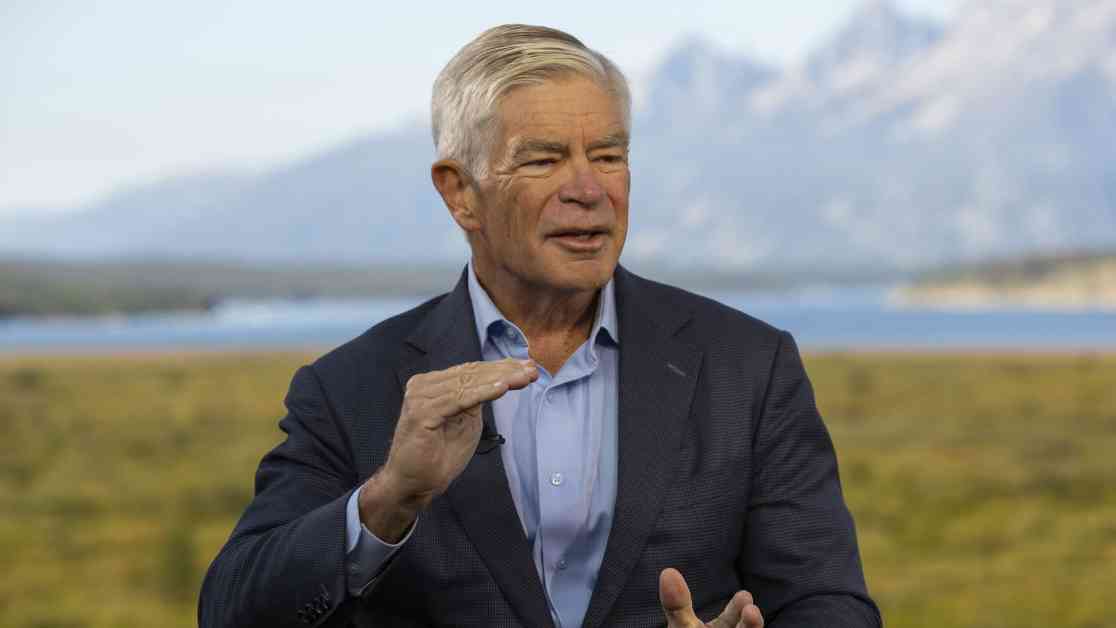

Philadelphia Federal Reserve President Patrick Harker is advocating for an interest rate cut in September, as he believes it is necessary to stimulate the economy. Speaking from the Fed’s annual retreat in Jackson Hole, Wyoming, Harker expressed his support for easing monetary policy to CNBC. This endorsement comes amidst growing speculation that a rate cut is imminent, with markets already pricing in a high probability of a quarter percentage point reduction.

Harker emphasized the importance of starting the process of moving rates down in September, stating that the Fed should ease methodically and signal well in advance. While the markets are anticipating a 25 basis point cut, there is also a possibility of a 50 basis point reduction. However, Harker mentioned that he is not yet decided on the magnitude of the cut and would like to see more data before making a final decision.

The Federal Reserve has kept its benchmark overnight borrowing rate unchanged since July 2023, as it grapples with persistent inflationary pressures. Following the July policy meeting, where officials expressed caution about cutting rates, there has been a shift in sentiment towards easing. Harker stressed that the decision on monetary policy should be based on data and not influenced by political considerations, especially with the upcoming presidential election.

Despite not having a vote on the rate-setting Federal Open Market Committee this year, Harker still plays a significant role in shaping policy discussions. Another non-voting member, Kansas City Fed President Jeffrey Schmid, also weighed in on the issue, suggesting a possible rate cut in the near future. Schmid highlighted the cooling of the labor market as a key factor driving the need for policy intervention, noting the gradual increase in the unemployment rate.

While acknowledging the impact of the high-rate environment on the banking sector, Schmid expressed confidence that banks have weathered the conditions well. He reiterated that monetary policy is not overly restrictive but emphasized the importance of monitoring the evolving economic indicators closely. Both Harker and Schmid’s perspectives underscore the Fed’s commitment to data-driven decision-making in navigating the current economic landscape.

Factors Influencing the Call for an Interest Rate Cut

The push for an interest rate cut stems from a combination of factors that have raised concerns about the health of the economy. Inflationary pressures have been a persistent challenge for the Federal Reserve, as rising prices have eroded consumers’ purchasing power. The Fed’s mandate to maintain price stability and full employment has been put to the test in recent months, prompting officials like Harker and Schmid to consider policy adjustments.

The labor market dynamics have also played a significant role in shaping the debate around interest rates. While the unemployment rate had been at historically low levels, there are emerging signs of a slowdown in job creation. This shift in the labor market landscape has implications for wage growth, consumer spending, and overall economic growth. The Fed’s decision to cut rates would aim to mitigate these risks and support sustainable economic expansion.

Moreover, the global economic environment has added to the uncertainties facing the Fed. Trade tensions, geopolitical risks, and slowing growth in key economies have heightened concerns about the outlook for the U.S. economy. The interconnected nature of the global financial system means that developments abroad can have ripple effects on domestic economic conditions, further underscoring the need for proactive policy measures.

Impact of an Interest Rate Cut on Financial Markets

The prospect of an interest rate cut has already had a significant impact on financial markets, with investors adjusting their positions in anticipation of the Fed’s decision. Equity markets have rallied on the expectation of lower borrowing costs, as lower interest rates typically boost corporate profitability and consumer spending. Bond markets have also reacted to the news, with yields on government bonds falling in response to the increased demand for fixed-income securities.

The banking sector, which is sensitive to changes in interest rates, has seen mixed reactions to the possibility of a rate cut. While lower rates could compress net interest margins for banks, they could also stimulate loan demand and support economic activity. Banks with diversified revenue streams and robust risk management practices are better positioned to navigate the changing interest rate environment and capitalize on new opportunities.

For consumers, an interest rate cut could translate into lower borrowing costs for mortgages, auto loans, and other forms of credit. This could provide a much-needed boost to household spending and support the housing market, which has shown signs of cooling in recent months. Lower interest rates could also incentivize businesses to invest in expansion projects and hire more workers, leading to a virtuous cycle of economic growth.

Challenges and Considerations in Implementing an Interest Rate Cut

While an interest rate cut may seem like a straightforward solution to stimulate the economy, there are several challenges and considerations that the Federal Reserve must take into account. One key concern is the risk of stoking inflationary pressures by lowering rates too aggressively. Inflation has been hovering near the Fed’s target of 2%, and any significant deviation could unsettle financial markets and erode consumer confidence.

Another consideration is the impact of lower rates on savers and retirees who rely on interest income for their livelihood. A prolonged period of low interest rates could squeeze their earning potential and force them to seek higher-yielding but riskier investments. The Fed must balance the need for economic stimulus with the potential unintended consequences of its policy actions, taking into consideration the diverse interests of different stakeholders.

Moreover, the effectiveness of monetary policy in stimulating the economy is not guaranteed, especially in an environment of heightened uncertainty and structural challenges. Fiscal policy, regulatory reforms, and structural adjustments are also critical components of a comprehensive strategy to promote sustainable economic growth. The Fed’s decision to cut rates should be part of a broader framework that addresses the root causes of economic imbalances and fosters long-term stability.

In conclusion, the advocacy for an interest rate cut by Philadelphia Fed President Patrick Harker reflects the evolving economic conditions and the Fed’s commitment to supporting growth and stability. The decision to ease monetary policy is a complex and nuanced process that requires careful consideration of multiple factors, including inflation, labor market dynamics, and global economic trends. By taking a data-driven approach and communicating transparently with the public, the Fed aims to navigate the current challenges and position the economy for sustainable growth in the future.