Emerging Asian bonds with shorter tenors are proving resilient in the face of tariff risks that are rattling global markets. Amidst the chaos of shifting trade policies and escalating tensions, these bonds are offering investors a safe haven from the storm.

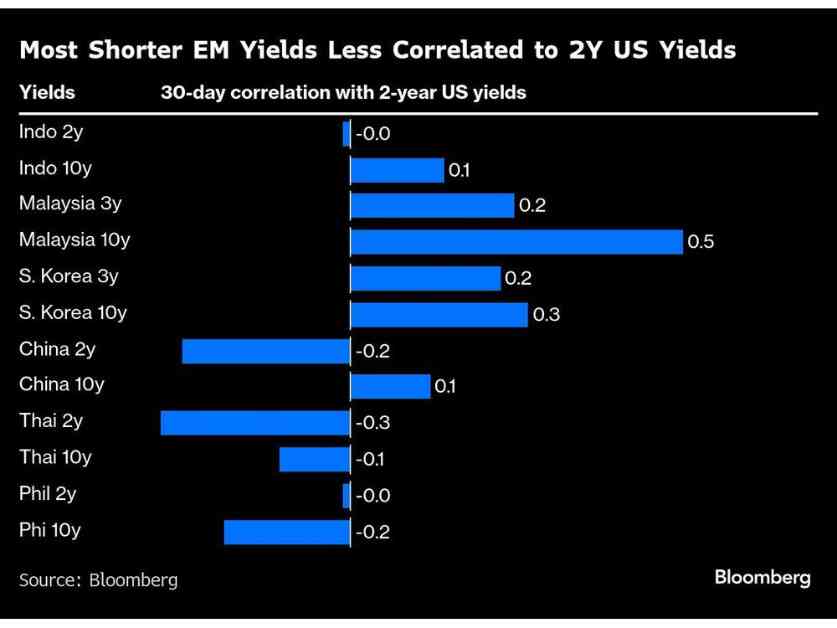

The analysis conducted by Bloomberg reveals an interesting trend in the correlation between the region’s shorter-term debt and two-year US yields. Surprisingly, the connection between these shorter-term Asian bonds and US Treasury yields is weaker than that of the region’s longer-term bonds. This indicates that the front-end bonds of five Asian nations are better equipped to weather the storm of tariff risks and the volatility in US rates.

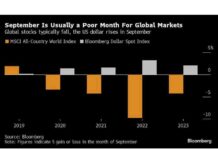

In times of uncertainty, it’s crucial for investors to find stability and security in their investments. This is where the appeal of shorter-dated emerging Asian bonds comes into play. With conflicting statements from US President Donald Trump regarding tariffs on Canada and Mexico, the deadline looms on the horizon, adding to the air of uncertainty. As the trade review on China approaches completion and reciprocal tariff policies are being evaluated, the probability of US tariff escalation remains high.

Rajeev De Mello, a portfolio manager at Gama Asset Management SA, emphasizes the importance of positioning investments along shorter-to-mid maturity interest-rate swaps or local-currency bond curves. As monetary policy in emerging Asian economies shifts towards easing, investors need to adapt to the changing landscape to stay ahead of the curve.

The recent decision by the Bank of Thailand to unexpectedly trim interest rates by 25 basis points highlights the proactive approach taken by central banks in the region. This move, coupled with similar rate reductions by the Bank of Korea and the guidance from Bangko Sentral ng Pilipinas, reflects a concerted effort to stimulate economic growth and mitigate the impact of global trade tensions.

Shorter dated yields in Indonesia, Malaysia, Thailand, the Philippines, India, and South Korea have seen a decline, providing a sense of stability amidst the chaos. The average decrease of 15 basis points in shorter-term yields compared to a six basis point drop in 10-year yields underscores the attractiveness of these shorter-dated bonds in the current market environment.

As investors navigate the choppy waters of global markets, the resilience of shorter tenor Asian bonds offers a ray of hope in uncertain times. By strategically positioning their investments and staying attuned to shifting monetary policies, investors can find solace in the stability and security offered by these bonds. In a world filled with uncertainty, these bonds stand as a beacon of resilience and strength, guiding investors through turbulent times.