Oman’s IPO Pipeline Faces Crucial Test: Analysis of $2.5 Billion Haul

In the tumultuous world of stock markets, Oman made waves last year by reeling in a staggering $2.5 billion from new share sales, surpassing even established markets like the UK. However, as the sultanate steps into 2025, it faces a critical litmus test of investor appetite.

The Oman Investment Authority-backed Asyad Group has taken the plunge, planning to offload at least a 20% stake in its shipping unit. This move comes on the heels of lackluster debuts for two initial public offerings, including the largest deal ever witnessed in Muscat. The Asyad Shipping Co.’s IPO is not just about raising capital; it is a litmus test of the government’s competency in executing its divestment program, which aims to privatize around 30 assets.

As Nishit Lakhotia, head of research at SICO Bank, aptly puts it, “Asyad’s success will be a much-needed catalyst for many more IPOs in the sultanate.” The recent IPOs in Oman left investors wanting more, with shares of OQ Exploration & Production SAOG plummeting by 17% since their October listing. OQ Base Industries SAOG’s stock, on the other hand, has remained stagnant since its debut last month. The story is no different for firms that went public in 2023, with OQ Gas Networks SAOC witnessing a 6% drop and Abraj Energy Services SAOG trading nearly 4% lower.

The lukewarm reception to recent Omani IPOs can be attributed to the subdued energy prices, affecting offerings tied to the oil and chemicals sectors. Hasnain Malik, an emerging and frontier markets strategist at Tellimer, believes that Oman’s market performance, as reflected in the 3% drop in the MSX 30 Index since October, is also influenced by external factors like the 7.5% rise in Brent crude futures.

Amidst this challenging backdrop, Asyad Shipping stands out as a beacon of hope. Providing essential marine transportation services for key exports, the business is deemed “relatively safe and sticky” by Lakhotia. Furthermore, a promising dividend policy could be the ace up Asyad Group’s sleeve in attracting investors.

Learning Curve

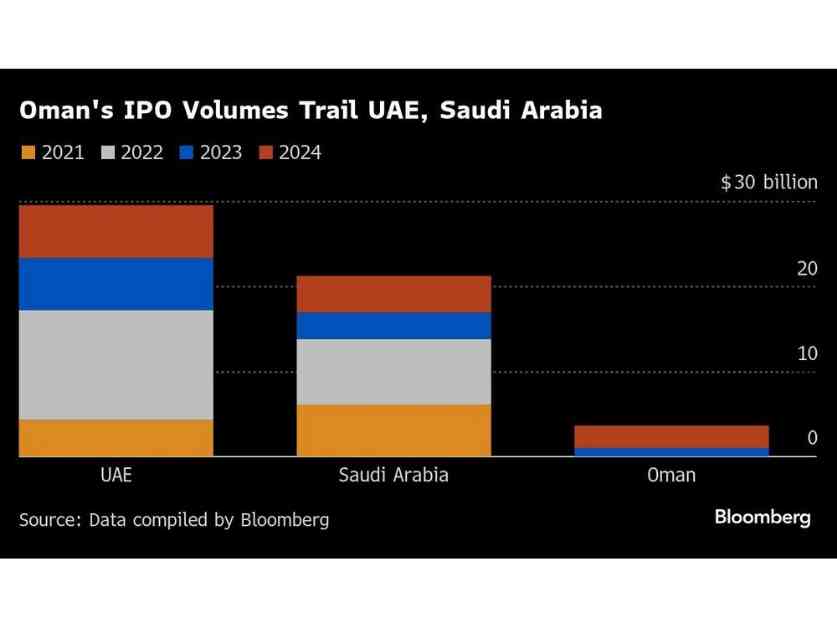

Despite Oman’s recent IPO frenzy, the sultanate still trails behind regional powerhouses like Saudi Arabia and the United Arab Emirates in its privatization efforts and capital market development. The Muscat Stock Exchange, boasting a market capitalization just above $31 billion, pales in comparison to its regional counterparts.

In a bid to catch up, Oman’s capital markets regulator has greenlit reforms to bolster private-sector listings and enhance secondary liquidity. According to Lakhotia, these reforms could act as the much-needed catalyst to propel Oman’s capital markets forward. Additionally, Oman is setting its sights on an upgrade to emerging-market status, a goal currently shared only by Bahrain within the Gulf Cooperation Council.

While Oman may have “some way to go” to meet the market capitalization requirements for the coveted upgrade, James Swanston, an economist at Capital Economics Ltd, remains optimistic. The country’s improving economic landscape is gradually boosting its appeal to investors, hinting at a brighter future.

However, the road ahead is not without its challenges. Stretched valuations, a common culprit behind lackluster IPOs in the Middle East, could pose a hurdle for Oman. As Asyad Shipping mulls over a valuation of at least $1 billion for its IPO, the stakes are high. Nonetheless, success stories like Nice One Beauty Digital Marketing Co. and Almoosa Health Co. in Saudi Arabia highlight the underlying appetite for private sector plays in the Gulf’s domestic economy.

As Malik from Tellimer succinctly puts it, “This should not prevent Oman from executing more privatizations, just maybe not at as high valuations as it previously hoped for.”

In the dynamic world of stock markets, Oman’s IPO pipeline faces a critical test. As the sultanate navigates through turbulent waters, the success of Asyad Shipping’s IPO could pave the way for a new era of privatizations and capital market development in Oman.