Asian Stocks Face Decline as China Data Looms: Market Update

Asian stocks are bracing for a downward trend as investors eagerly await a slew of Chinese data releases and a promise from Chinese regulators to stabilize the markets. The looming shadow of uncertainty hovers over South Korean assets following the impeachment of President Yoon Suk Yeol. The future seems uncertain as equity futures in Australia, Hong Kong, and mainland China point towards losses, while those in Japan show signs of gains. The S&P 500 managed to trim initial losses on Friday, hinting at a potential hawkish stance by the Federal Reserve in the upcoming week.

Chinese Markets in Focus

Amidst a backdrop of market volatility, Chinese stocks are expected to extend a downward trend sparked by disappointment over Beijing’s vague promise to boost consumption without concrete stimulus details. Regulators have stepped in to reassure investors by pledging to stabilize both property and equity markets, with a particular emphasis on monitoring futures and spot trading activities. The People’s Bank of China is likely to maintain a cap on the yuan amidst looming US tariffs, according to analysts at Commonwealth Bank of Australia.

Political Turmoil and Market Responses

The recent political turmoil in South Korea, triggered by President Yoon’s impeachment, has led the Bank of Korea to vow the use of all available policy measures to stabilize the stock and currency markets. With Yoon currently suspended from exercising presidential powers, the nation is navigating uncharted waters as the prime minister steps in as acting president. Societe Generale analysts foresee monetary and fiscal stimulus measures to counter the ongoing political unrest.

Global Market Outlook

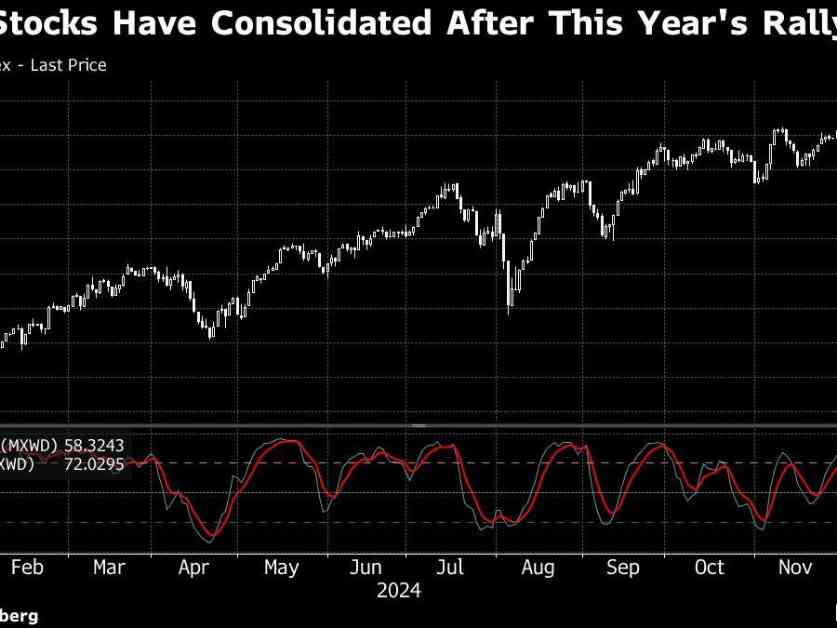

As global markets gear up for a series of central bank meetings, including the Fed, Bank of Japan, and Bank of England, traders brace themselves for a potential slowdown in the almost 20% rally seen in global stocks this year. Uncertainty looms over the market as traders navigate event risks and potential position squaring in the wake of a tumultuous year.

In conclusion, the global market landscape remains fraught with volatility and uncertainty as investors navigate economic data releases, political upheavals, and central bank policies. The coming week promises to be a test of resilience and adaptability for traders and investors worldwide. Stay tuned for more updates on how these developments will shape the future of the financial markets.