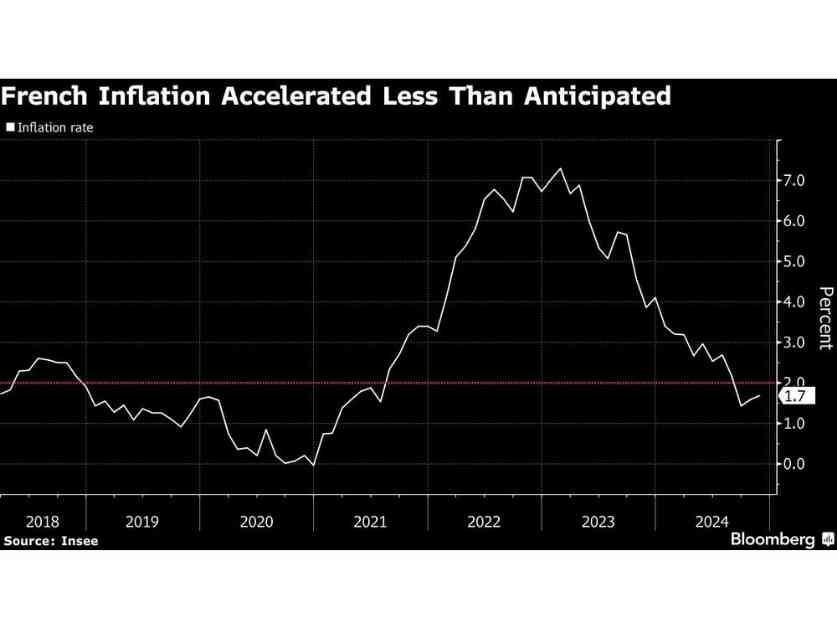

French inflation rose less than expected, indicating a weakening economy and suggesting that interest rates may need to be lowered further. Consumer prices in France increased by 1.7% in November compared to the previous year, falling short of the anticipated 1.8% rise. This slow pace of inflation is well below the European Central Bank’s 2% target.

The European Central Bank is likely to implement a fourth cut in borrowing costs at its upcoming monetary-policy meeting, despite some speculation about a half-point reduction. Inflation numbers across Europe have been mixed, with Spain experiencing an expected uptick, Germany maintaining steady price gains, and the euro zone as a whole projected to accelerate to 2.3%.

In France, services prices saw a slight increase to 2.5%, while energy costs continued to decline, albeit at a slower rate. These economic indicators come at a time of political unrest in France, with budget disputes causing financial market turmoil. Additionally, consumer spending unexpectedly dropped in October for the first time since June, and consumer confidence hit a low point not seen since June.

The French economy showed a 0.4% increase in economic output in the third quarter, indicating a slow but steady growth rate. The data released by Insee highlight the challenges facing the French economy as it navigates through political and economic uncertainties.

Overall, the economic landscape in France is complex, with inflation below expectations, declining consumer spending, and political instability affecting market confidence. The upcoming decisions by the European Central Bank will be crucial in determining the future trajectory of the French economy and its impact on the broader euro zone.