Stock Market Update: Stocks Surge as Payrolls Expected to End Volatile Week

Stocks have seen a surge in anticipation of Friday’s crucial US jobs data. This comes at the end of a turbulent week marked by mixed earnings from tech giants, putting the market on edge. Additionally, oil prices have risen due to escalating tensions in the Middle East.

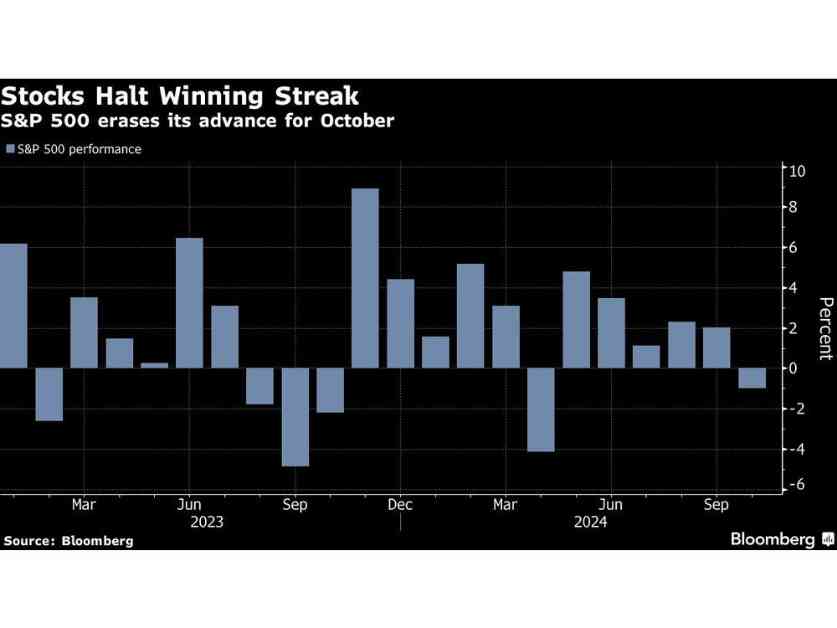

Amazon.com Inc. and Intel Corp. stocks have experienced significant gains in premarket trading following positive earnings reports. However, Apple Inc. saw a decline after reporting weaker demand in China. Futures on the S&P 500 are showing a slight increase, but the benchmark is on track for its worst weekly performance in over a year. This unease is driven by concerns about the future of artificial intelligence and cloud computing following the earnings reports from Microsoft Corp. and Meta Platforms Inc.

Today’s payrolls report is expected to show a slowdown in job growth, following a recent increase in an inflation measure favored by the Federal Reserve. This has added uncertainty ahead of the upcoming Federal Reserve policy meeting. Investors are also preparing for next week’s US election, with the CBOE Volatility Index, also known as the Fear Gauge, reaching levels last seen during market turmoil in August.

The Stoxx Europe 600 index has seen a 0.5% increase, despite heading towards its largest weekly drop in two months. Energy stocks have supported this rise, with companies like Shell Plc, Total Energies SE, and BP Plc seeing gains of over 1% as oil prices climb.

Reckitt Benckiser Group Plc experienced a significant surge of 10% after one of its units was cleared by a jury of allegations regarding health risks associated with a premature-infant formula.

US Treasuries have remained steady after slight gains the previous day. However, October marked the worst month for Treasuries in two years due to increased selling reflecting a reassessment of US interest rates in light of the strong economy.

In the currency markets, the dollar has rebounded after a two-day decline, with the yen weakening following comments from Bank of Japan Governor Kazuo Ueda on the impact of currency markets on the economy.

Across Asia, equity markets have seen a decline, with Japanese stocks leading the losses. However, Chinese equities rose following positive property sales data and an unexpected uptick in manufacturing activity, indicating the effectiveness of recent stimulus measures by Beijing.

Oil prices have continued to rise amid reports of Iran planning a retaliatory strike on Israel through its backed militias in Iraq.

In summary, the stock market is experiencing a surge as investors await key economic data and navigate through a volatile week marked by mixed earnings reports and geopolitical tensions. The upcoming US election and Federal Reserve policy meeting add further uncertainty to the market landscape.