Private Equity Tax Break: Understanding Carried Interest

Private equity firms have been in the spotlight recently due to the controversial tax break known as carried interest. This tax break allows private equity fund managers to pay a lower tax rate on their income compared to the average worker.

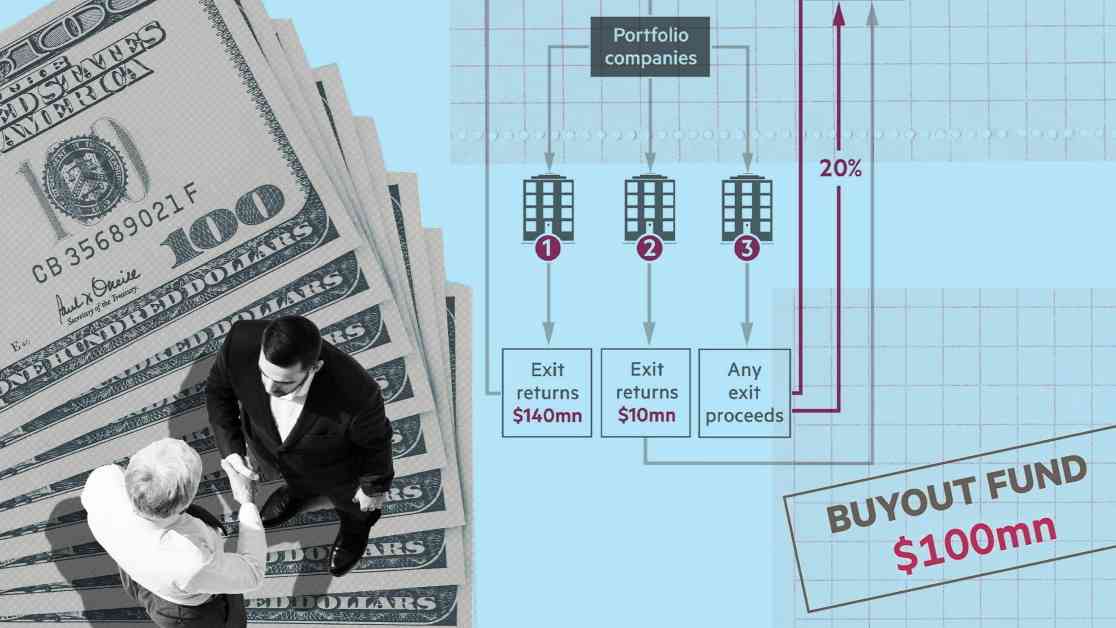

Carried interest is the share of profits that fund managers receive as compensation for managing the fund. This share of profits is typically around 20% of the fund’s profits. The controversy arises from the fact that this income is treated as capital gains instead of ordinary income, which is taxed at a lower rate.

Critics argue that this tax break allows wealthy fund managers to pay significantly lower taxes on their income compared to other high-income individuals. They believe that this loophole in the tax code unfairly benefits the wealthy and contributes to income inequality.

On the other hand, supporters of carried interest argue that it incentivizes fund managers to take risks and generate higher returns for their investors. They believe that taxing carried interest at a lower rate encourages investment and economic growth.

Despite the debate surrounding carried interest, efforts to change the tax treatment of this income have been unsuccessful so far. Lawmakers have proposed various reforms to close this tax loophole, but none have been successful in passing.

It is important for the public to understand the implications of carried interest and the impact it has on the tax system. As the debate continues, it will be crucial to consider the potential consequences of changing the tax treatment of carried interest on the private equity industry and the broader economy.

In conclusion, carried interest remains a contentious issue in the world of private equity. Understanding the complexities of this tax break is essential for policymakers and the public alike. As discussions around tax reform continue, it will be interesting to see how this issue evolves and whether any changes will be made to the current tax treatment of carried interest.