The UK government recently announced potential tax rises as part of a pro-business budget. The Chair of the Confederation of British Industry (CBI) shared their perspective on whether these tax increases are acceptable. The CBI Chair emphasized the importance of balancing the needs of businesses with the broader economic goals of the country.

According to the CBI Chair, while it is important to support businesses and promote economic growth, it is also crucial to ensure that the government has the necessary funds to invest in public services and infrastructure. The Chair acknowledged that tax rises may be necessary to achieve these goals, but emphasized the need for careful consideration and consultation with businesses before implementing any changes.

The CBI Chair also highlighted the importance of creating a tax system that is fair and transparent for all businesses. They stressed the need for clarity and consistency in tax policies to provide businesses with the certainty they need to plan for the future. The Chair called for a collaborative approach between the government and businesses to ensure that any tax changes are implemented in a way that supports economic growth and job creation.

Overall, the CBI Chair’s perspective on the potential tax rises in the pro-business budget is one of cautious support. While recognizing the need for government revenue to fund public services, the Chair emphasized the importance of working together to create a tax system that benefits both businesses and the broader economy.

In addition to the CBI Chair’s perspective, it is important to consider the views of other stakeholders, such as small businesses, workers, and economists. Small businesses, in particular, may have concerns about the impact of tax rises on their bottom line and ability to grow. Workers may also be concerned about the potential effects of tax increases on their wages and job security.

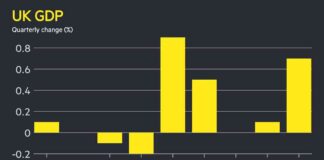

Economists may provide valuable insights into the potential economic consequences of tax rises, such as changes in consumer spending, investment, and overall economic growth. By considering a range of perspectives, policymakers can make informed decisions that balance the needs of businesses with the broader goals of the economy.

Ultimately, the debate over tax rises in a pro-business budget is a complex issue that requires careful consideration and consultation with a variety of stakeholders. By engaging in open and transparent dialogue, policymakers can ensure that any tax changes support economic growth and prosperity for all.