Oil prices took a hit as the market awaited Israel’s response to Iran’s recent missile attack. President Joe Biden advised against striking Iran’s oil fields, causing Brent to fall below $78 a barrel. Despite the tension, the demand outlook, especially from China, and concerns about oversupply continue to weigh on the market.

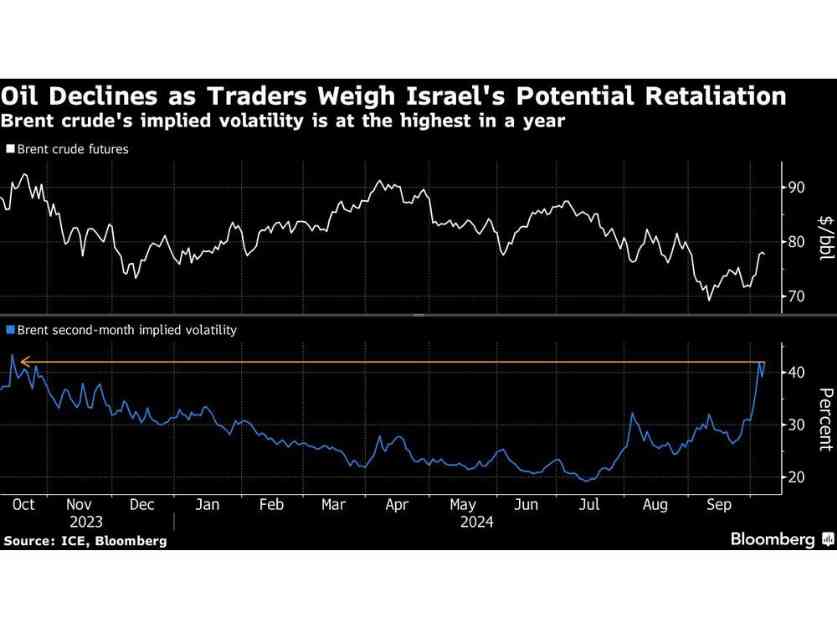

The situation in the Middle East remains volatile, with Israel taking military action in Gaza and Lebanon. Iran’s oil production has nearly recovered to full capacity, but it could be at risk if tensions escalate further. The options market reflects a bullish sentiment, with buyers favoring call options that profit from futures gains. Implied volatility for Brent has reached its highest level in almost a year, indicating market uncertainty.

According to JPMorgan Chase & Co. analysts, oil prices are likely to include a geopolitical risk premium until the conflict between Israel and Iran is resolved. They suggest that attacking Iran’s energy facilities may not be the best course of action. Meanwhile, Saudi Arabia has increased its main oil prices for Asian buyers while lowering prices for exports to the US and European markets.

The evolving situation in the Middle East underscores the interconnectedness of global oil markets and geopolitical events. Investors and market analysts are closely monitoring developments in the region to assess the potential impact on oil prices and market trends. The ongoing tensions highlight the importance of geopolitical stability in maintaining a balanced and stable oil market.