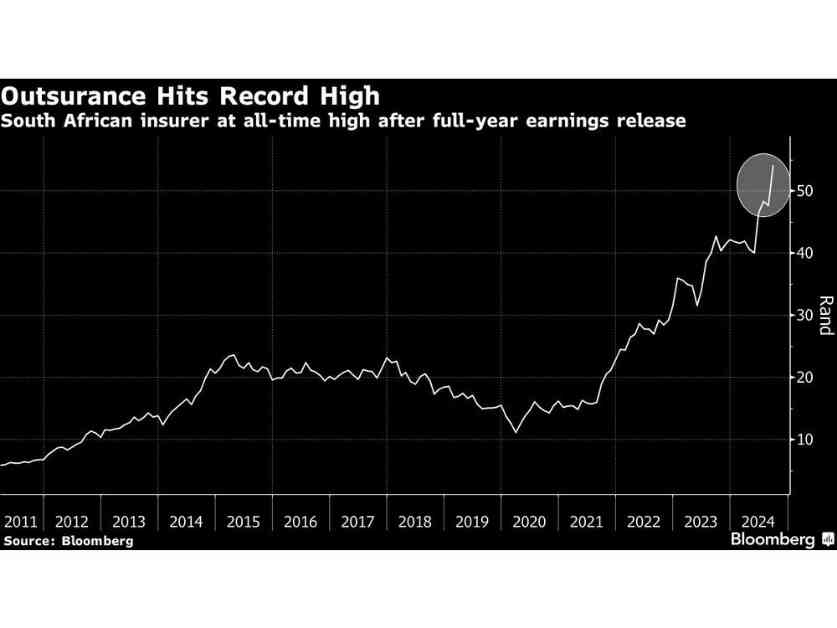

OUTsurance, a prominent South African insurer with operations in Australia and Ireland, has experienced a significant surge in growth, leading to record profits and a special dividend payout for its shareholders. The company reported a 36% increase in net income to 4.06 billion rand ($230 million) for the year ending in June, marking a substantial improvement from the previous year.

Special Dividend Announcement:

As a result of the surplus funds in one of its units, OUTsurance has declared a special dividend of 0.40 rand per share in addition to a total dividend of 1.74 rand per share, representing a 29% increase compared to the previous year. This announcement has propelled the company’s stock price to new heights, with shares climbing 8.5% to 55.38 rand, reaching their highest level since OUTsurance acquired Rand Merchant Investment Holdings Ltd.’s listing on the Johannesburg Stock Exchange.

Business Growth and Expansion:

The growth in profits can be attributed to the 21% increase in gross written premiums in the property and casualty business, reaching 33.2 billion rand. This growth was primarily driven by elevated inflation and high interest rates in the markets where OUTsurance operates, as well as improved performance in acquiring new business. The company’s CEO, Marthinus Visser, emphasized the importance of simplifying the business operations and seizing opportunities presented by the improving economic conditions in South Africa.

Future Prospects and Strategic Initiatives:

Visser outlined the company’s strategic priorities, including capitalizing on the economic upturn in South Africa to reverse the trend of stagnant growth experienced over the past decade. Despite challenges such as energy crises and infrastructure deficiencies, OUTsurance remains optimistic about its prospects in the region. Additionally, the company plans to focus on its Ireland business and aims to break even within the next five years, demonstrating its commitment to long-term sustainability and profitability.

Conclusion:

OUTsurance’s remarkable performance and strategic initiatives underscore its resilience and ability to capitalize on opportunities in a challenging economic environment. By delivering record profits, announcing a special dividend, and outlining a clear growth strategy, the company has positioned itself for continued success in the insurance industry. As OUTsurance continues to expand its presence both locally and internationally, investors can look forward to sustained growth and value creation in the years to come.