Europe’s Top Stock Performers Facing Decline: Impact on Future Returns

The engines behind two years of European stock gains are losing power, leaving the region’s equities facing a void at a time when concerns over slowing growth and China tensions are testing investor confidence.

The luxury sector led by LVMH Moët Hennessy Louis Vuitton SE has tumbled over the past six months along with automotive firms, while in more recent months healthcare heavyweights such as Novo Nordisk A/S and tech leaders including ASML Holding NV have slid from their peaks. And with no obvious candidates to take the baton, the region’s equity performance has been left looking exposed.

Leadership Shift in European Markets

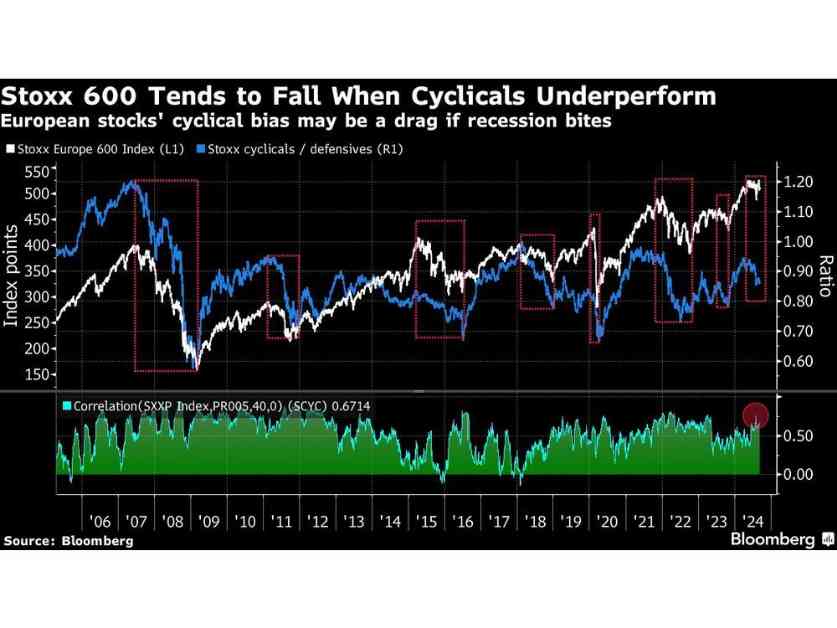

The European market is experiencing a shift in leadership, with smaller and more defensive sectors now leading the way. The region’s equity market is traditionally more cyclical than its US counterpart, with economically-sensitive sectors accounting for about two-thirds of the benchmark Stoxx 600. However, these sectors are now at risk due to slowing growth and trade tensions with China.

Investor Concerns and Market Dynamics

Investors have withdrawn billions of dollars from Europe-focused funds and ETFs this year, contrasting the large inflows into US and international equity funds. The main drivers of the region’s gains have fallen behind America’s tech giants, leading to concerns about future performance.

European companies heavily rely on Chinese demand, with firms receiving about 8% of their revenues from the Asian country. Trade tensions and slowing growth in China pose significant risks to European companies, especially those with a large percentage of their revenue coming from the US and China.

Industry-Specific Challenges

Europe’s energy heavyweights, such as BP Plc, Shell Plc, and TotalEnergies SE, are facing challenges due to low oil prices and uncertainty in the energy market. London’s mining stocks are also feeling the impact of falling iron ore and copper prices.

In contrast, Big Tech in the US has been a major driver of stock market performance, with tech companies accounting for a significant portion of returns. In Europe, the healthcare sector is among the top contributors to the Stoxx 600 index’s returns, along with consumer staples firm Unilever Plc.

Outlook and Opportunities

With the European market’s former leaders fading, investors are looking for new opportunities in sectors such as banking and utilities. European banks have seen a strong performance this year, and there is potential for further gains given their low valuations. Utilities are also expected to perform well due to lower interest rates and the prospect of rising dividends.

Fund managers believe that segments of the stock market are ready to take over market leadership if a recession is averted. Small and mid-cap companies could be the next drivers of market performance if economic growth rebounds.

In conclusion, the European stock market is facing challenges as its top performers decline, but there are opportunities for new leaders to emerge and drive future returns. Investors should stay informed about market dynamics and industry-specific risks to make informed decisions about their portfolios.