Revival Expected in Asia’s Initial Public Offerings in 2025

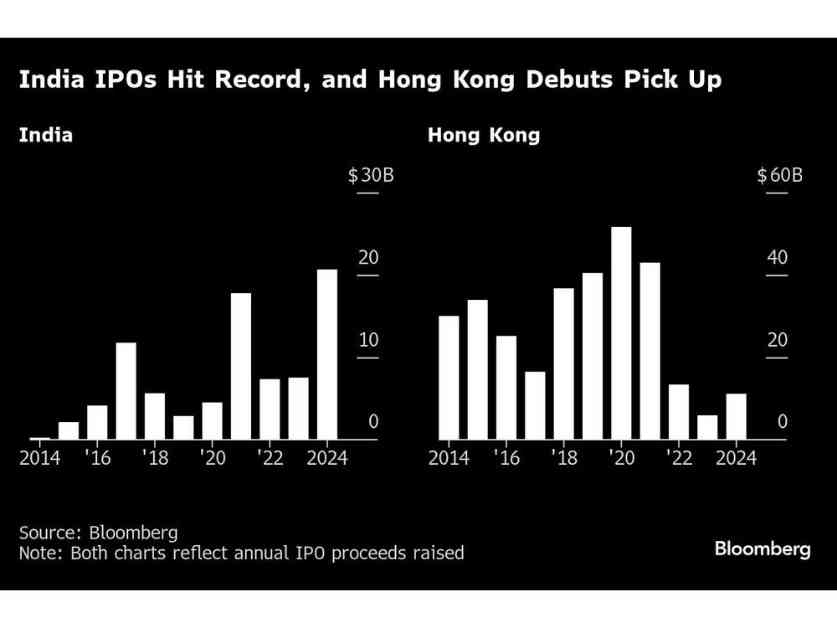

Dealmakers are gearing up for an exciting year ahead as they eye a revival in Asia’s initial public offerings (IPOs) in 2025. The spotlight is on Asia, with India’s robust pipeline and a rebound in Hong Kong’s market setting the stage for significant new-share sales.

India’s IPO Market Set to Soar

India is poised to surpass last year’s record of $20.7 billion in new-share sales, driven by a resilient economy and strong demand from mutual funds fueling a stock market surge. The country’s IPO market is expected to thrive, with a wave of exciting offerings on the horizon.

Hong Kong Deals on the Horizon

In Hong Kong, mainland-listed companies are gearing up for share offerings that are set to inject new momentum into the city’s IPO market. Some of the notable deals to keep an eye on include:

– Contemporary Amperex Technology Co.: The world’s top electric-vehicle battery maker, commonly known as CATL, is preparing for a second listing in Hong Kong that could raise at least $5 billion.

– Jiangsu Hengrui Pharmaceuticals Co.: The company is exploring a Hong Kong listing that might raise at least $2 billion.

– Foshan Haitian Flavouring & Food Co.: One of China’s largest condiment makers, Haitian, is planning a second listing in Hong Kong that could raise at least $1.5 billion.

– Seres Group Co.: Huawei Technologies Co.’s electric-vehicle partner is considering a Hong Kong listing that could raise over $1 billion.

– Eastroc Beverage Group Co.: The Chinese energy-drink maker is contemplating a listing in Hong Kong that could raise up to $1 billion after a previous plan for a Swiss share sale fell through.

Exciting IPOs in India and Beyond

Apart from Hong Kong, other Asian countries are gearing up for some major IPOs in 2025. Some of the key listings to watch out for include:

– HDB Financial Services Ltd.: The unit of HDFC Bank Ltd. plans to raise up to 125 billion rupees ($1.5 billion) through an IPO.

– LG Electronics India: LG Electronics Inc. is eyeing a valuation of up to $15 billion for its Indian unit’s listing in the first half of the year.

– Quest Global Services Pte: Carlyle Group Inc. is considering an IPO of the engineering-services firm that could raise around $1 billion.

– Zetwerk Pvt Ltd.: The supply-chain startup is exploring fundraising options, including an IPO that could raise up to $1 billion.

– Mahle GmbH’s India business: The German car-parts maker is mulling an IPO of its Indian business, potentially raising up to $400 million.

Conclusion

With a promising lineup of IPOs across various sectors and regions, 2025 is shaping up to be an exciting year for investors and market enthusiasts alike. Stay tuned for more updates on the latest developments in Asia’s dynamic IPO landscape.