US inflation progress has hit a roadblock in October, with the core consumer price index likely remaining stagnant compared to the previous month. Economists predict that the last leg of the journey towards the Federal Reserve’s target will be the most challenging, as the unwinding of pandemic-era price distortions has been slow.

In October, core goods prices are expected to rise, driven by increased demand for cars and auto parts following Hurricanes Helene and Milton. The slow progress in unwinding price distortions has been exacerbated by the storms, with more people staying in hotels due to evacuation orders, leading to a sluggish decline in services prices.

Despite the challenges, Fed Chair Jerome Powell remains confident that inflation is on a downward trend, and a couple of bad reports will not alter this pattern. The US government will release wholesale inflation figures, which are expected to show an uptick after stalling in September. Additionally, strong earnings growth, outpacing inflation, is likely to contribute to another rise in retail sales.

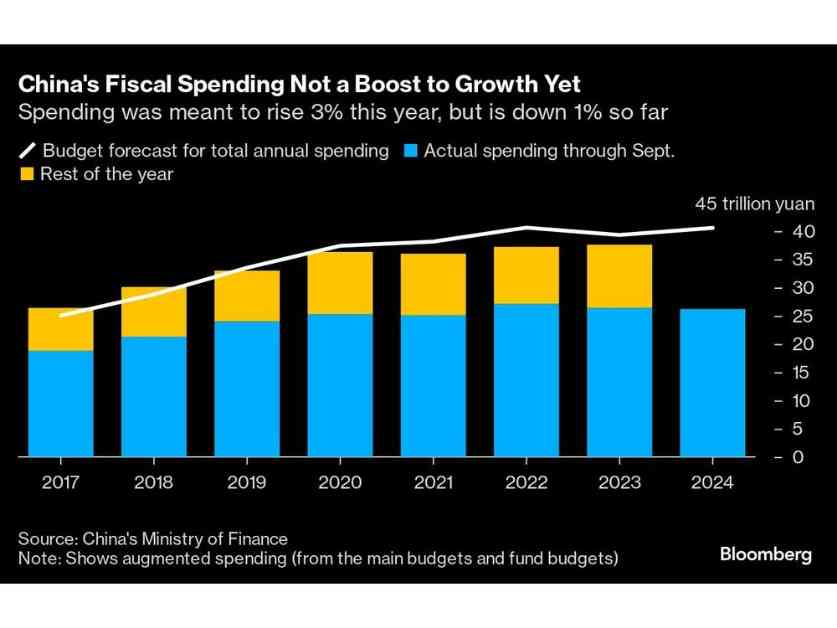

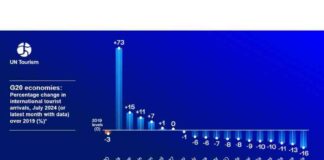

Looking ahead, a busy week for data includes economic numbers from China, wage and growth statistics from the UK, and inflation readings from India to Argentina. The European Union will also publish new economic forecasts. Central banks around the world will be closely monitoring these data points to gauge the health of the global economy.

In conclusion, while US inflation progress may have stalled in October, the overall trend remains on a downward trajectory. The road ahead may be challenging, but policymakers are closely monitoring the situation to ensure stability in the economy. Stay tuned for more updates on global economic developments.