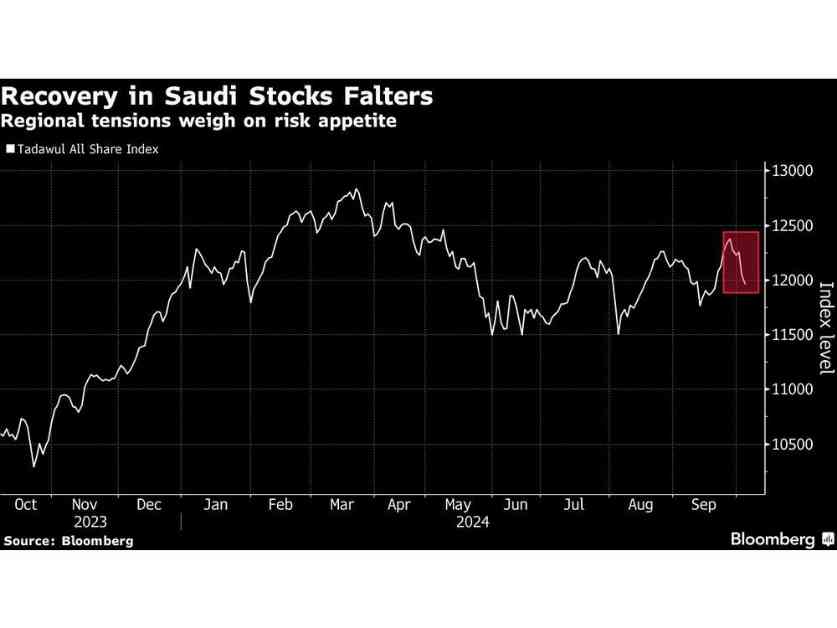

Investors in the Saudi stock market are on edge as tensions in the region escalate, causing the Riyadh bourse to experience a rough start to the fourth quarter. The Tadawul All Share Index dropped by 2.2% in the first three days of October due to rising conflicts between Israel and Iran-backed Hezbollah, as well as Tehran’s missile attacks. Despite the market’s resilience to previous tensions and low oil prices, the recent events have erased all gains made so far this year.

With uncertainties looming, experts like Ryan Lemand, the CEO of Neovision Wealth Management, suggest that investors are wary of investing during times of war and geopolitical conflicts. Jassim Al-Jubran, head of sell-side research at Aljazira Capital, anticipates continued market pressure in the short term, with the Tadawul index potentially dropping by 5% but rallying if conditions improve in the region. The possibility of a direct military clash among regional parties is a cause for concern, especially given Saudi Arabia’s aim to stay neutral.

Oil prices play a crucial role in the Saudi stock market, as the country heavily relies on energy revenues. Despite efforts to diversify the economy through Vision 2030, the kingdom still needs oil prices to balance its books. HSBC Holdings Plc strategists have downgraded Saudi Arabian equities to neutral due to heightened geopolitical risks and low oil prices. While Brent crude futures have increased due to fears of supply disruptions, they remain below the necessary level of $96 per barrel to sustain the economy.

Abdulwahhab Abed, acting CEO of Sedco Capital, believes that oil prices would need to stay below $69 a barrel for an extended period to pose significant risks to the Saudi stock market. On the other hand, some investors like Mohammed Al-Suwayed, CEO of Razeen Capital, view the market downturn as a chance to buy stocks at discounted prices during times of regional tension. Overall, the future of the Saudi stock market remains uncertain as it navigates through escalating conflicts and economic challenges.