The European Central Bank surprised everyone by cutting interest rates, a move that was unexpected just a month ago. This decision is likely to accelerate the global trend towards monetary easing. Economists predict that this rate cut is just the beginning of a series of actions to help the eurozone economy cope with the impact of high borrowing costs.

ECB President Christine Lagarde will address the media after the meeting and may provide insights into future rate cuts and the reasons behind this sudden change in policy. While some officials were hesitant about inflation pressures, recent data indicating a contraction in the private sector has pushed them towards this decision.

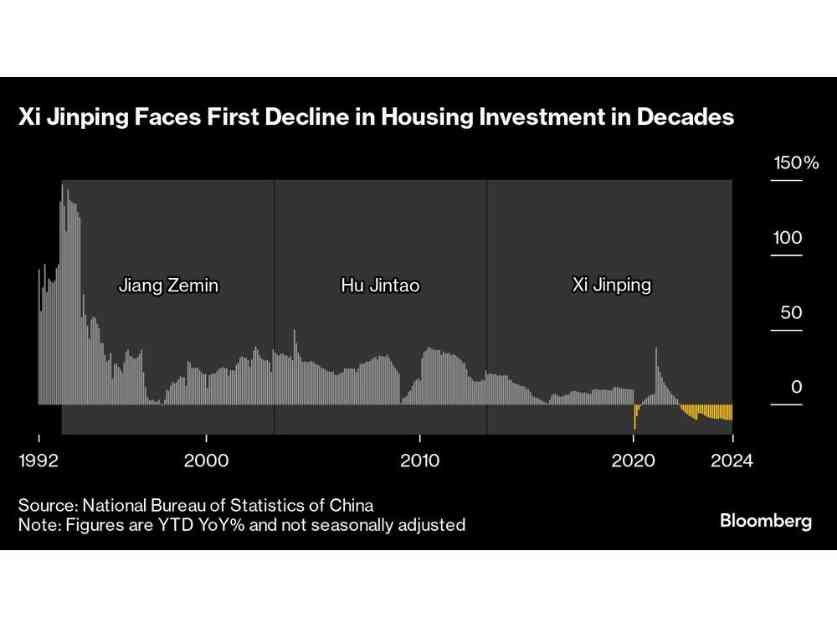

Looking ahead, economists believe that the ECB will continue to lower borrowing costs to stimulate the economy by the end of 2025. In addition to the ECB decision, there are other key events happening globally. Chinese economic data, central bank rate decisions in Southeast Asia and Chile, UK inflation numbers, and the announcement of the Nobel Prize in economics are all on the horizon.

In the US and Canada, reports on retail sales, manufacturing, and housing starts will provide insights into the strength of the economy. The Bank of Canada will be monitoring core inflation data for any signs of cooling. In Asia, China’s economic growth figures are expected to show continued underperformance, leading to more aggressive easing measures. Meanwhile, Japan, Australia, and Singapore will release important economic data throughout the week.

In Europe, the focus will be on the UK, with data on wages, inflation, and retail sales being closely watched. The eurozone is also facing economic challenges, with Germany expected to see a contraction this year. Italy’s fiscal affairs, Israel’s inflation rate, and South Africa’s monetary policy review are other events to watch out for.

In Latin America, Chile is expected to cut interest rates, while Peru, Brazil, Colombia, and Mexico are expected to provide updates on their respective economies. Unemployment rates, industrial production, and GDP readings will give a clearer picture of the economic situation in these countries.

Overall, the global economy is facing challenges, and central banks are taking proactive measures to stimulate growth and mitigate the impact of various economic factors. Stay tuned for more updates on these developments in the coming days.