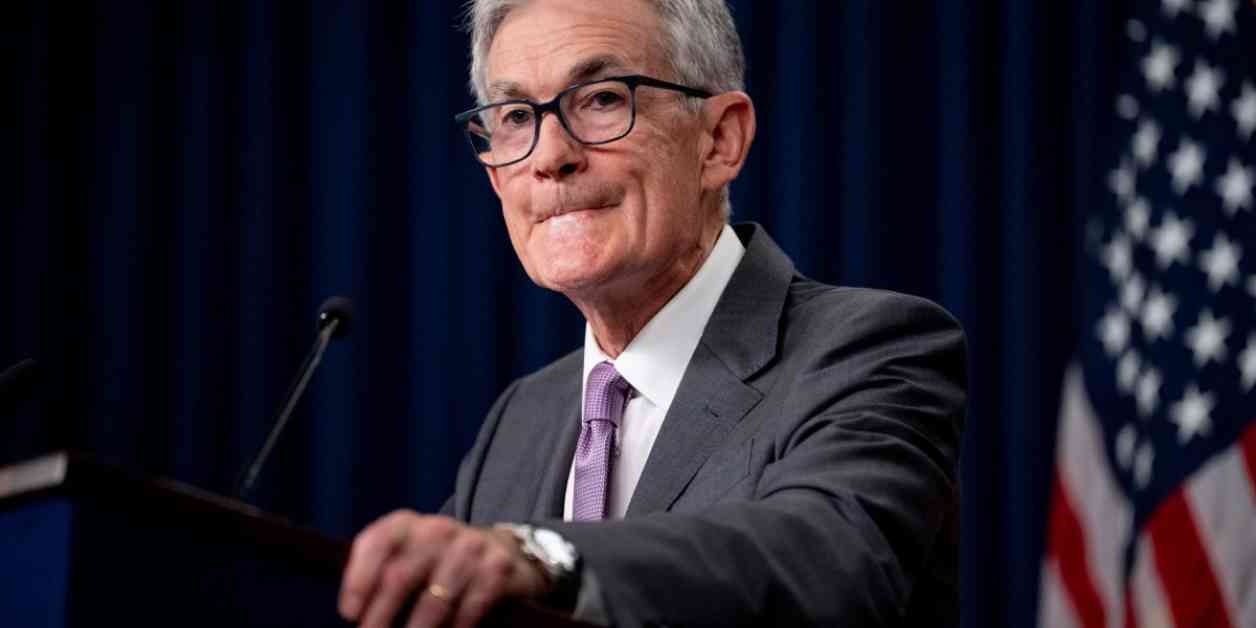

Federal Reserve Chair Jerome Powell is set to suggest rate cuts amid falling inflation as the central bank shifts its focus to the health of the job market. With inflation cooling towards its 2% target, the pace of hiring slowing, and the unemployment rate edging up, the Fed is preparing to lower its benchmark interest rate from its 23-year high. The upcoming rate cut is expected to have a ripple effect on consumer borrowing, leading to lower rates for auto loans, mortgages, and other forms of borrowing.

Chair Powell is expected to provide insights into the Fed’s economic outlook and potential next steps in a high-profile speech at the Fed’s annual conference of central bankers in Jackson Hole, Wyoming. This platform has historically been used by Powell and his predecessors to signal changes in their thinking or approach to monetary policy.

The Fed seems to be gaining confidence that inflation is on track to reach its 2% target, a key factor that would trigger rate cuts. Economists agree that the Fed has made progress in taming high inflation that plagued households in the years following the pandemic recession. However, Powell and other Fed officials are not ready to declare victory just yet.

The focus has now shifted to the labor market, with the Fed closely monitoring hiring trends and unemployment rates to determine the pace of future rate cuts. Recent economic data, including lower-than-expected job growth and an increase in the jobless rate to 4.3%, have raised concerns about a potential recession. However, positive economic reports such as a decline in inflation and a strong increase in retail sales have alleviated some of these fears.

Wall Street traders are now expecting three quarter-point rate cuts by the Fed in September, November, and December. Mortgage rates have already started to decline in anticipation of these rate reductions. However, the possibility of a half-point rate cut in September remains if there are signs of a further hiring slowdown.

Raphael Bostic, president of the Fed’s Atlanta branch, indicated that evidence of accelerating weakness in labor markets could prompt a more rapid rate cut. The next jobs report scheduled for release in early September will provide crucial data for the Fed’s decision-making ahead of its mid-September meeting.

Despite the uncertainties surrounding the economy, most economists agree that the Fed is likely to cut rates this year given the progress made in controlling inflation. The recent report showing a modest 2.9% increase in consumer prices from a year ago suggests that inflation is under control, giving the Fed room to maneuver with rate cuts.

Bostic and Austan Goolsbee, president of the Fed’s Chicago branch, emphasize the importance of adjusting policy to prevent a potential economic slowdown. With inflation-adjusted interest rates rising as inflation slows, the Fed is mindful of the impact on businesses and investors. The Fed’s goal is to achieve a “soft landing,” where inflation returns to the 2% target without triggering a recession.

As Powell prepares to address the central bank’s next steps at the Jackson Hole conference, the focus remains on incoming economic data to guide future policy decisions. While Powell may not be able to commit to a specific trajectory, the Fed’s cautious approach aims to balance the need for continued economic growth with the risks of inflation and job market instability.

In conclusion, the Fed’s upcoming rate cuts signal a shift in focus towards supporting economic growth and maintaining stability in the face of changing market conditions. Powell’s speech at the Jackson Hole conference will provide valuable insights into the Fed’s thinking and potential actions in the coming months. With inflation under control and the labor market showing signs of weakness, the Fed’s decisions will be crucial in navigating the challenges ahead.