Asia’s Market Performance at the Start of 2025: Wrap-Up

Asian stocks kicked off the New Year on a somber note following a turbulent end to the prosperous 2024 for global equity investors. The S&P 500 and Nasdaq 100 indexes took a hit in a year-end pullback, wiping out over a trillion dollars from large-cap market values. Futures on benchmarks in Shanghai dipped, and mainland Chinese gauges plummeted on the final trading day of December. Meanwhile, shares in Sydney opened relatively unchanged.

Market Outlook

While most Asian shares were anticipated to decrease on Thursday, futures indicated that Hong Kong’s benchmark might see a slight uptick. Japanese markets were closed until January 6, New Zealand was still on holiday, and South Korea was scheduled for a late opening. Energy markets were in focus as trading resumed following the halt of Russian gas flowing to Europe via Ukraine. This event marked the end of a transit deal that had been operational for five decades.

Global Economic Landscape

Oil prices saw a surge on the last day of 2024 amidst expectations of a global surplus in 2025. Treasury bonds saw a modest annual gain in 2024, albeit lower than the previous year. The Bloomberg Dollar Spot Index had its strongest performance in nearly a decade.

In the business realm, Nippon Steel Corp. made a significant offer to the US government, Alibaba Group Holding Ltd. agreed to sell its shares in Sun Art Retail Group Ltd., and China’s BYD Co. reported a substantial surge in sales.

Regional Economic Highlights

At a macroeconomic level, China’s President Xi Jinping projected a 5% expansion for the country in 2024. Singapore’s Prime Minister Lawrence Wong shared that the economy exceeded expectations with a 4% GDP growth. However, South Korea faced political turmoil as Acting President Choi Sang-mok rejected his advisers’ collective resignation attempt.

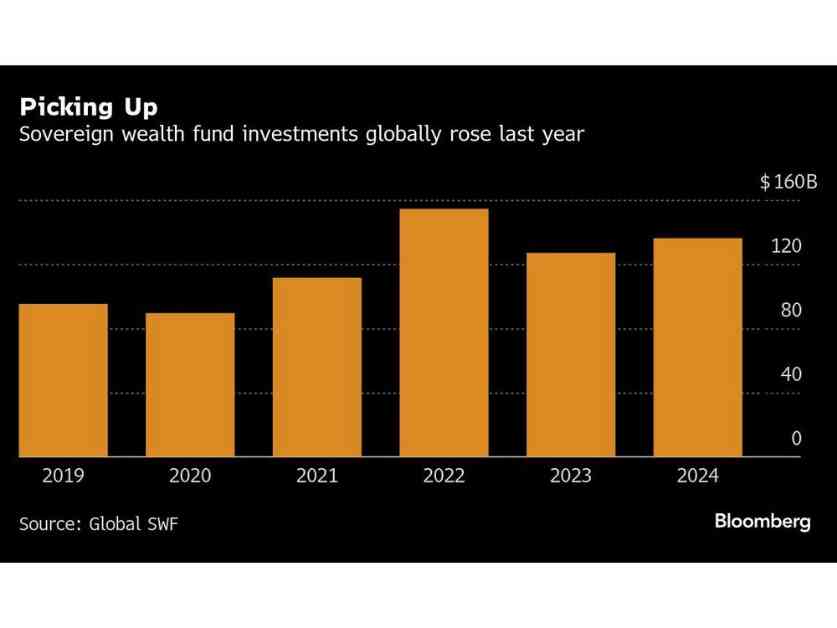

Australian house prices experienced a decline for the first time in 22 months in December, attributed to increased property supply and pricing challenges for buyers. Abu Dhabi’s Mubadala Investment Co. emerged as the most active sovereign wealth fund globally in 2024, while Saudi Arabia’s Public Investment Fund shifted focus to domestic investments.

In conclusion, despite the challenges and uncertainties looming in the global economic landscape, investors and market participants are gearing up for a dynamic and eventful year ahead. With key events and indicators on the horizon, stakeholders are closely monitoring market movements and macroeconomic developments to navigate through the complexities of 2025.