Brazil’s Economy Exceeds Expectations, Triggering Alert for Potential Rate Hike

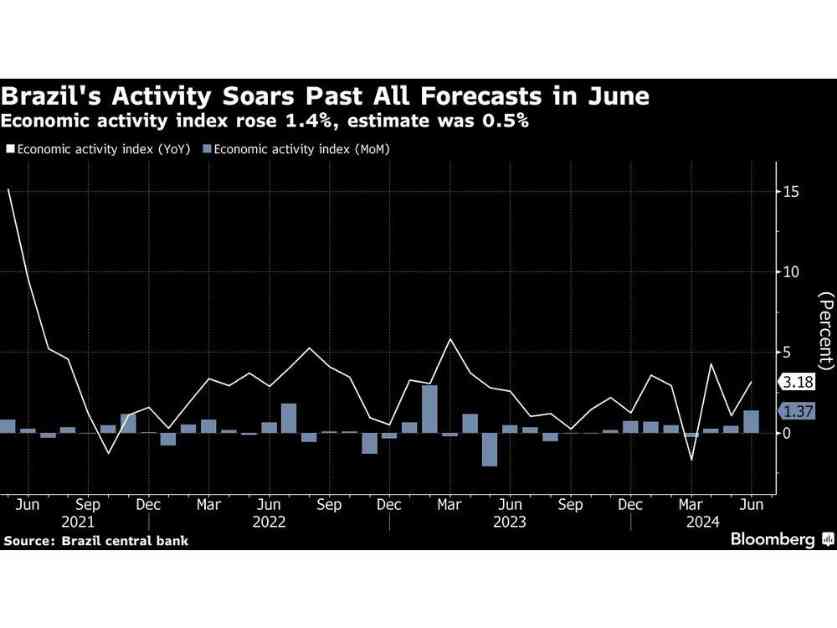

Brazil’s economy has shown remarkable growth in June, surpassing all expectations and prompting central bankers to consider the possibility of raising interest rates once again. The country’s economic activity index, which serves as a proxy for gross domestic product, surged by 1.4% in June compared to May. This growth exceeded all estimates in a Bloomberg survey, which had a median forecast of 0.5%. Year-on-year, the index recorded a 3.2% increase, as reported on Friday.

Analysts have been steadily revising their growth projections for Latin America’s largest economy, with most now anticipating a GDP expansion of over 2% this year despite the high interest rates. In June, industrial output experienced its most significant increase since 2020, while services volume outperformed expectations. However, retail sales saw a decline for the first time since December.

Bloomberg Economics Analysis

Bloomberg economists note that the June activity data indicates that Brazil’s economy outperformed growth expectations in the second quarter, despite facing tighter financial conditions and severe floods in the south. While this positive performance is likely to keep the central bank vigilant for signs of overheating, it may not be sufficient to warrant an immediate interest rate hike. The forecast suggests that policymakers are likely to maintain the Selic rate at 10.5% through mid-2025. However, with robust economic activity and a rise in underlying inflation, the possibility of a rate hike cannot be ruled out entirely.

Central Bank’s Response

The central bank, under the leadership of Roberto Campos Neto, decided to keep the benchmark Selic rate at 10.5% in the previous month, emphasizing their readiness to implement rate hikes if necessary. In July, annual inflation reached the upper limit of the bank’s tolerance range at 4.5%, driven by a surge in service costs and core measures that exclude energy and food items.

Campos Neto acknowledged the positive surprises in economic activity, stating that analysts projecting a 2.2% growth rate for the year are likely to revise their estimates upwards to over 2.5%. He underscored the need for a cautious approach, highlighting that the economy has demonstrated resilience even in the face of high interest rates.

Looking Ahead

Monetary Policy Director Gabriel Galipolo has indicated that all options are on the table for the upcoming rate-setting meeting in September, considering the sustained demand and low unemployment rates. The central bank remains vigilant regarding potential inflationary pressures, including escalating service costs, inflation forecasts, and currency fluctuations.

Campos Neto reiterated the bank’s commitment to achieving its inflation target, affirming that they are prepared to take necessary measures, including rate hikes, to address any deviations. Meanwhile, President Luiz Inacio Lula da Silva is expected to appoint a successor to Campos Neto, whose term as central bank governor concludes in December.

President Lula, known for his criticism of high interest rates as impediments to economic growth, advocates for a balanced approach that considers both inflation and economic activity levels. His administration aims to stimulate the economy through increased public spending, emphasizing the importance of holistic policy measures to support sustainable growth.

In conclusion, Brazil’s robust economic performance has exceeded expectations, leading to discussions about the potential need for a rate hike to address inflationary pressures. As policymakers navigate these challenges, maintaining a delicate balance between economic growth and price stability will be crucial for the country’s long-term economic prosperity.