The Federal Reserve’s preferred inflation gauge is expected to hit a seven-month low, a sign that price pressures are starting to ease. This slowdown is reflected in the core personal consumption expenditures price index, which excludes food and energy costs, likely rising by 2.6% in the year through January. Overall PCE inflation is also expected to have eased on an annual basis, according to a Bloomberg survey of economists.

Implications for Policy

Despite this decrease in inflation, policymakers remain cautious about lowering interest rates further. The Federal Reserve is closely monitoring the situation and is expected to keep rates on hold for the time being. The decline in inflation is likely coming from categories that were relatively tame in separate wholesale inflation data, but strong increases in the consumer price index are keeping the PCE above the Fed’s 2% target.

Global Economic Outlook

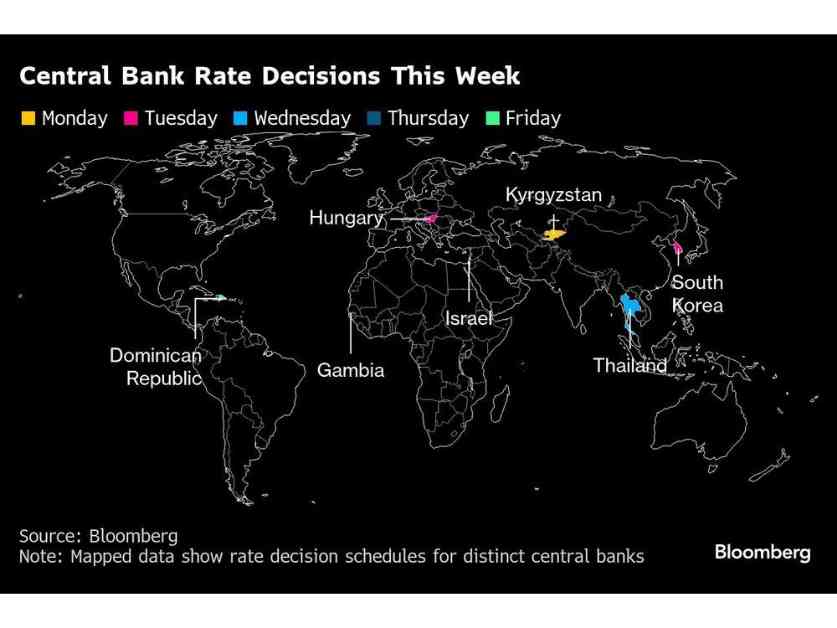

In Canada, GDP data for the fourth quarter is anticipated to show economic growth picking up steam after aggressive rate cuts. However, concerns over a looming trade war could stall this momentum. In other parts of the world, events like Germany’s election, inflation in Australia and the eurozone, and a rate cut in South Korea are expected to impact the global economy.

In Asia, central banks like the Bank of Korea and the Bank of Thailand are under scrutiny for their rate decisions. Meanwhile, in Europe, the aftermath of Germany’s election and upcoming economic data releases will be closely watched. In Latin America, countries like Mexico, Chile, and Argentina are navigating economic indicators like inflation, unemployment, and GDP growth to forecast their economic outlook.

Overall, the global economy is facing a precarious phase, with markets shaky and the easing cycle at risk due to US protectionist policies. Uncertainties around trade wars, inflation, and economic growth are influencing central banks’ decisions around the world. As we move forward, it will be crucial to monitor these developments to understand the trajectory of the global economy.

This article provides a comprehensive overview of the current economic landscape, highlighting key factors influencing inflation, interest rates, and economic growth across different regions. By analyzing these trends, we can gain valuable insights into the future direction of the global economy.