Amidst the bustling financial landscape, a recent development at CaixaBank SA has sparked apprehension and whispers of government intervention. As the board prepares for a significant overhaul with the impending end of five directors’ terms in April, concerns loom large about potential shifts in influence. Reports suggest that some independent board members fear being replaced by individuals with close ties to the Socialist administration, raising eyebrows and prompting discussions behind closed doors.

The unease within the boardroom paints a picture of the complex relationship between Criteria, the country’s largest industrial investment group, and the government. Over the past year, Criteria has strategically positioned itself as a key private-sector partner for the government, aligning its interests with the administration’s hands-on approach to corporate affairs. The departure of former Chairman Jose Ignacio Goirigolzarri in October sent ripples of uncertainty through the board, prompting independent members Joaquin Ayuso and Francisco Javier Campo to consider stepping down in solidarity, citing concerns about corporate governance.

In response to these rumblings, CaixaBank emphasized that the current board remains unchanged, with plans to convene the annual shareholders meeting on February 20 to propose new appointments based on the recommendations of the appointment committee. While the government denied any direct involvement in the selection process, Criteria reiterated its commitment to non-interference in the board’s composition. CEO Gonzalo Gortazar reassured the public of the board’s cohesion, highlighting the harmonious dynamic among members during a recent press conference.

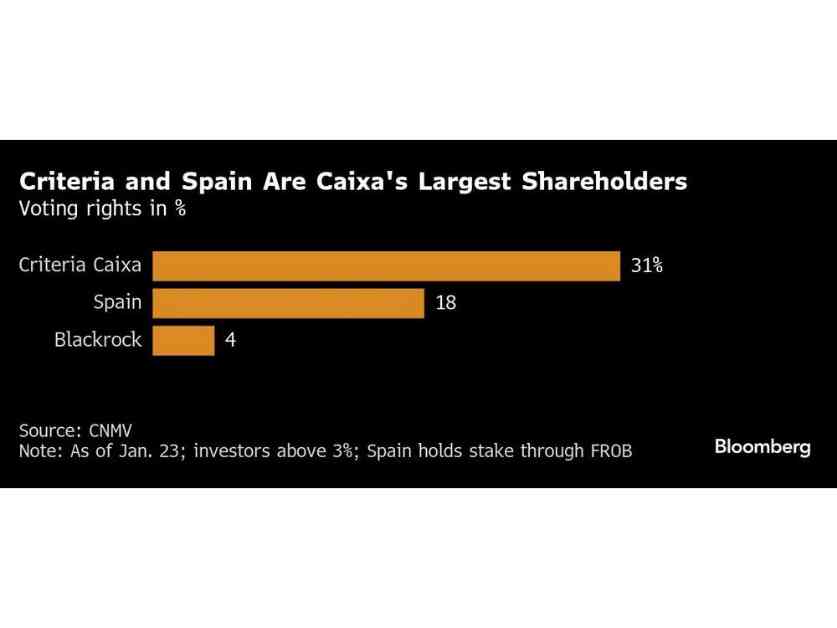

As the terms of Ayuso and Campo draw to a close in April, the bank faces the task of identifying candidates with strong technical backgrounds to fill these crucial roles. With Criteria owning a significant stake in Caixa and holding two board seats, alongside the government’s ownership of 18% and one seat, the delicate balance of power hangs in the balance. The recent collaboration between Criteria and the government in orchestrating leadership changes at Telefonica SA underscores the potential for similar maneuvers at CaixaBank, albeit with added scrutiny from the European Central Bank.

The government’s entry into Caixa’s shareholder roster in 2021 following the Bankia acquisition marked a significant shift in the bank’s ownership structure, paving the way for potential changes in governance. With regulatory oversight looming large, the fate of the five directors whose terms are set to expire remains uncertain, raising questions about continuity and potential replacements. The intricate web of relationships within the board, coupled with the impending vacancies, sets the stage for a pivotal moment in CaixaBank’s corporate trajectory.

As CaixaBank navigates these uncharted waters, stakeholders and industry observers alike are closely monitoring the unfolding saga. The composition of the board, the delicate dance between Criteria and the government, and the broader implications for corporate governance in Spain’s financial sector all hang in the balance. With the spotlight firmly fixed on CaixaBank, the decisions made in the coming months will not only shape the bank’s future but also reverberate across the broader financial landscape.

In this ever-evolving landscape of power dynamics and corporate governance, the fate of CaixaBank’s board hangs in the balance, poised at the intersection of competing interests and strategic maneuvers. As the financial world watches with bated breath, the next chapter in CaixaBank’s story promises to be a riveting tale of ambition, influence, and the delicate dance of power in the modern banking sector.