Oil prices took a significant hit recently due to various factors affecting the market. The drop in prices was mainly attributed to a decrease in demand in China, a stronger US dollar, and concerns about a potential oversupply in the market.

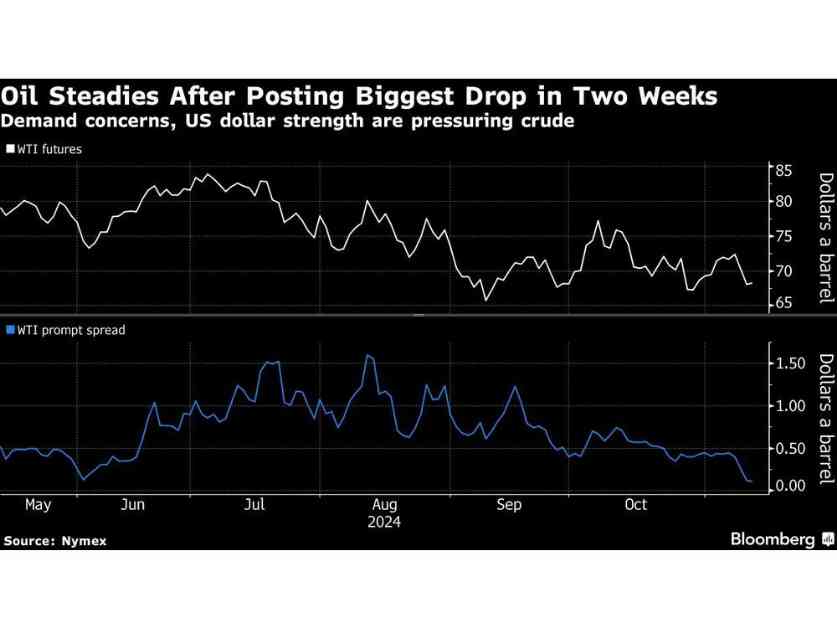

The price of West Texas Intermediate oil hovered around $68 a barrel after experiencing a more than 3% decrease on Monday, while Brent closed below $72. China’s efforts to boost its economy did not involve direct stimulus measures, and inflation in the country remains low. Additionally, the value of the US dollar has reached a one-year high following Donald Trump’s victory, leading to higher commodity prices for most buyers.

Oil has been trading within a narrow range for the past month as traders closely monitor geopolitical tensions in the Middle East, the US presidential election, and decisions made by OPEC+ regarding output levels. The outlook for the oil market remains pessimistic, as global supply is anticipated to surpass demand in the coming year. The release of OPEC’s monthly market report, scheduled for later this week, is expected to provide more insight into the market balance.

Despite some indicators showing a relatively tight market, such as nearby contracts trading at a premium to longer-dated ones, spreads have been narrowing. For example, the gap between WTI’s two closest contracts was at 11 cents a barrel in backwardation, a significant decrease from over 70 cents a month ago.

Following OPEC’s analysis, the US will release its short-term outlook on Wednesday, with the International Energy Agency sharing its perspective the day after. OPEC recently revised its demand forecasts downward, indicating a potentially challenging period ahead for the oil market.

Overall, the recent drop in oil prices underscores the delicate balance between supply and demand in the global market. Factors such as geopolitical tensions, economic policies, and currency fluctuations continue to influence the price of oil, making it a volatile and closely watched commodity in the financial world. Investors and industry experts will be closely monitoring upcoming reports and developments to gauge the future direction of oil prices.