Key Charts to Watch in Global Commodity Markets

The global commodity market is always bustling with activity, and staying informed about key trends and developments is crucial for investors, analysts, and industry experts. Here are five essential charts to keep an eye on this week:

Gold

Gold prices have been soaring to record highs, sparking discussions among stakeholders at the Denver Gold Group’s annual forum in Colorado Springs. The precious metal has seen a remarkable 25% increase this year, hitting new all-time highs along the way. This surge has not only boosted investor interest in gold but has also led to a significant rise in the stock prices of top producers like Newmont Corp., Barrick Gold Corp., and Agnico Eagle Mines Ltd.

Oil

The premium for gasoline and diesel futures over West Texas Intermediate crude oil, known as the 3-2-1 crack spread, has plummeted to its lowest levels since February 2021. Sluggish oil consumption growth, particularly in China, coupled with softer economic data in the US, is raising concerns about demand. The narrowing crack spread could put pressure on oil refiners, potentially leading to production cuts to avoid oversupply.

Wheat

Hot and dry weather conditions have impacted wheat crops in key producing regions like Russia, Germany, and France, resulting in lower harvests compared to the previous year. Despite these challenges, the global wheat harvest is expected to reach a record 797 million metric tons in the current crop year. This abundance of supply has driven down wheat prices by 5.3% this year, benefiting millers and bakers.

Nuclear

Investors are showing renewed interest in nuclear energy, with fund managers betting on its resurgence. Nuclear energy stocks have been the top performers over the past three years among climate-solution providers. While there are concerns about nuclear waste and uranium supply, proponents argue that nuclear reactors offer emissions-free energy production, making them a viable option for environmentally conscious portfolios.

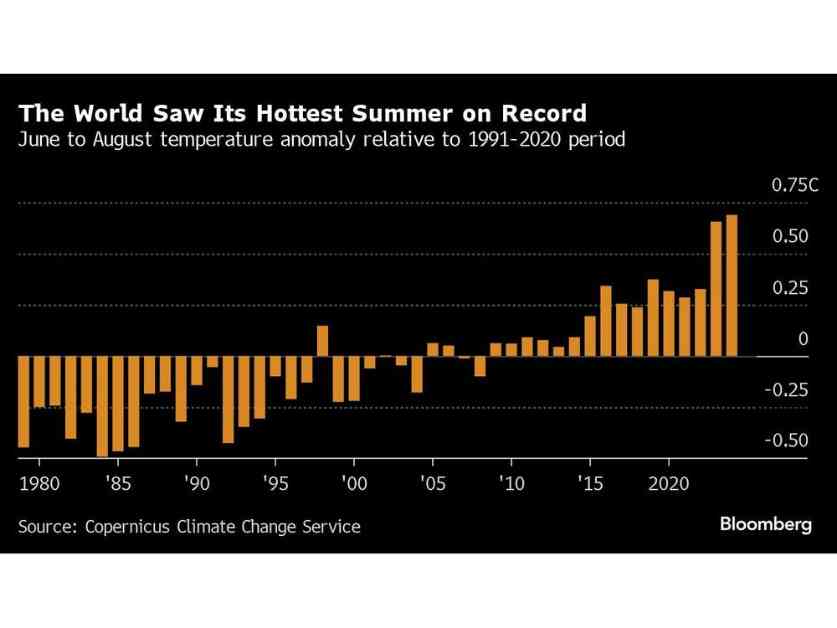

Weather

As the Northern Hemisphere’s summer draws to a close, the impact of climate change on global temperatures is becoming more evident. Recent data from the European Union’s Copernicus Climate Change Service shows that global temperatures have soared to 0.69C above historical averages from June to August, surpassing the previous record set last year. This rise in temperatures has intensified heat waves, droughts, wildfires, storms, and flooding, posing challenges for commodities markets worldwide.

In conclusion, staying informed about these key charts in the global commodity market can provide valuable insights for investors and industry professionals. By monitoring trends in gold, oil, wheat, nuclear energy, and weather patterns, stakeholders can make informed decisions and navigate the complexities of the commodity market effectively.